I’ve signed up for many blogs and Facebook groups about money, business & investing in the last 5 years. Suze Orman, the Budgetnista, my banks’ newsletters…

I’ve signed up for many blogs and Facebook groups about money, business & investing in the last 5 years. Suze Orman, the Budgetnista, my banks’ newsletters…

I’ve saturated my brain space with such things at this point and I’ve learned a lot along the way. What’s challenging, however, is the fact that I’ve hit a wall. Some of this may just be lil’ ole’ me having zero willpower to implement new financial patterns, but I’ve brain stormed what’s not right (saying “wrong” sounds wrong) about the advice I’m seeing populate my many newsfeeds, pages and inboxes.

1 – The rags to riches story is tired. A lot of advice starts from the assumption that you’re poor. Setting aside all the debates that argue that many poor people actually think they’re middle class, these “she used to have $12 in her bank account and now she has $1 Million” stories have grown old. I don’t want to be a millionaire and I definitely don’t have $12 in my bank account. I’m looking for tips on how to improve from okay to great, not how to save myself from destitution. The lessons aren’t the same, so the inspirational story loses impact, because the practical steps to make a change aren’t replicable.

2 – Entrepreneurship is hard. I appreciate the messaging around being a business owner and acting as one’s own boss, but actually doing it is not easy. Dare I say, it’s less fun than showing up at a “day job,” which could be totally boring, but not nerve wracking. Investing your savings in a business venture that’s supposed to grant financial freedom is a pipe dream. If it’s really yours, as a successful business will be, you are duty bound to making that business succeed, keeping up its reputation and growing its reach. To my mind, that’s the exact opposite of freedom, if you’re doing it right. It’s a huge emotional and time commitment that I don’t think many people are truly prepared for.

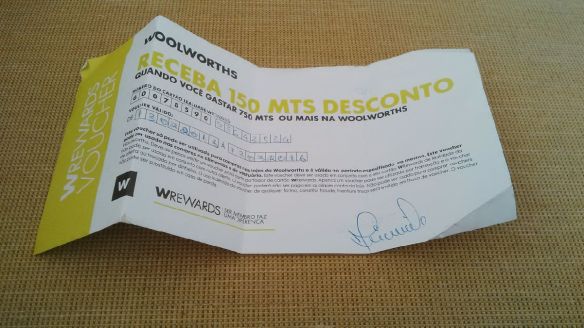

3 – Save money when you spend. Coupon clipping, deal seeking, promotion pimping shoppers still spend money. Yet, I find that many blogs don’t promote less consumption, just lower costs of consumption. And while I’m a good capitalist like the next woman with ten fingers and ten toes, I have to say that this is exactly the type of mind set that keeps sweatshops in business. If you don’t want to spend money, don’t shop. But, if you need/want to, I think it should be done with a conscience and awareness about the supply chain the purchase comes from. Even if we can’t afford to get out of the trap of supporting cheap(er) labor, we should be aware that we’re doing it and make efforts to ensure that our financial situation improves such that we can lessen the habit.

3 – Save money when you spend. Coupon clipping, deal seeking, promotion pimping shoppers still spend money. Yet, I find that many blogs don’t promote less consumption, just lower costs of consumption. And while I’m a good capitalist like the next woman with ten fingers and ten toes, I have to say that this is exactly the type of mind set that keeps sweatshops in business. If you don’t want to spend money, don’t shop. But, if you need/want to, I think it should be done with a conscience and awareness about the supply chain the purchase comes from. Even if we can’t afford to get out of the trap of supporting cheap(er) labor, we should be aware that we’re doing it and make efforts to ensure that our financial situation improves such that we can lessen the habit.

4 – Why do I have homework? Many blogs and books give you lessons, but I’ve found that many newsletters and groups are dishing out homework too. I’ve seen everything from accountability partners to daily tasks for financial wellness. I have the attention span of a fly when it comes to things that aren’t about work, school or family, so these reminders convert to spam and spam into trash. And there’s a vicious cycle of mass deletions.

5 – Everything on stocks sucks. I haven’t read anything good about stocks yet. I suppose it’s pretty plain that there’s no good “how to” guide for stock market and bond investing, but it just feels like all the books and blogs seem to say 1) keep your money in for at least 10 years, 2) don’t pull out when everyone else is and don’t invest when/where everyone else is, 3) invest in what you use and 4) only invest money you can afford to lose. Anything else?… If not, let’s not keep printing big books and articles that add other fancy pants words around these basic lessons.

6 – The charity and tax nexus are non-starters. Last but not least, there are 2 issues that very rarely show up in these advice columns. How to manage income and taxes to net more AND how to integrate philanthropy into a budget. Better yet, if I can find anything on how charitable spending can help lower taxable income, I’ll be sure to send the author home made chocolate chip cookies. Sure, maybe we all should hire a financial planner to figure this out for our individual situation… maybe… but can I just get some basic principles? just one article? one book? or one measly little blog post? Or nahh…

That said, for those of you who want to troll the wealth of financial baggage I’ve accumulated over the years, please check out the list below. It’s chocked full of useful info, but it’s not what I’m looking for anymore. To help me get past this money advice rut, share resources that worked for you in the comments section.

Sharing (even sharing frustrations) is caring!

5. My hair has had just about enough of these dainty chemical free botanical moisturizers. It’s time to step away from the

5. My hair has had just about enough of these dainty chemical free botanical moisturizers. It’s time to step away from the

The Ta Ta Top

The Ta Ta Top